Buyout Funds

Award Winning Buy-out Funds

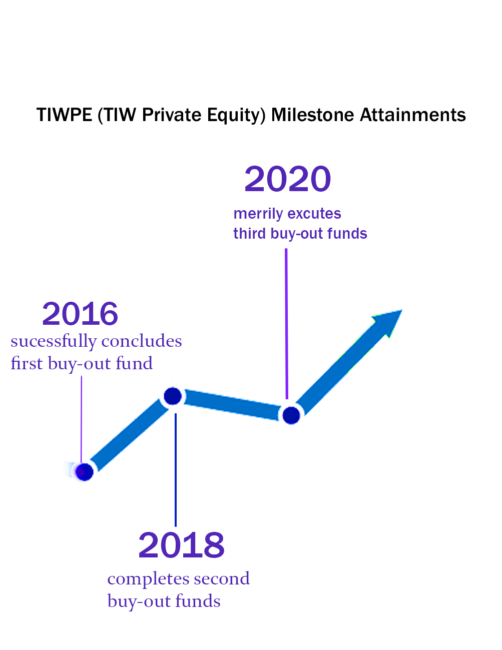

TIWPE (TIW Private Equity) family of funds is concentrated on the FRICT agnostic sector, growth, and margin expansion opportunities. We are invested in opportunities in India and poised to extend our remit beyond that market, to the Asia Pacific region.

TIW proposes a balanced buyout fund to generate a combination of fixed return and equity upside for its investors. Our investment technique adds hands-on investment sort with an ‘operating consultant approach’. to offer Investors capital protection and security.

TIW Private Equity has won Two Awards in the Global Brands Awards 2021 by

Global Brands Magazine, UK, in the categories of:

❖ Most Innovative Private Equity Buyout Fund, India

❖ Excellence in Sustainable Turnaround Investment.

TIWPE BUYOUT FUND: OBJECTIVES

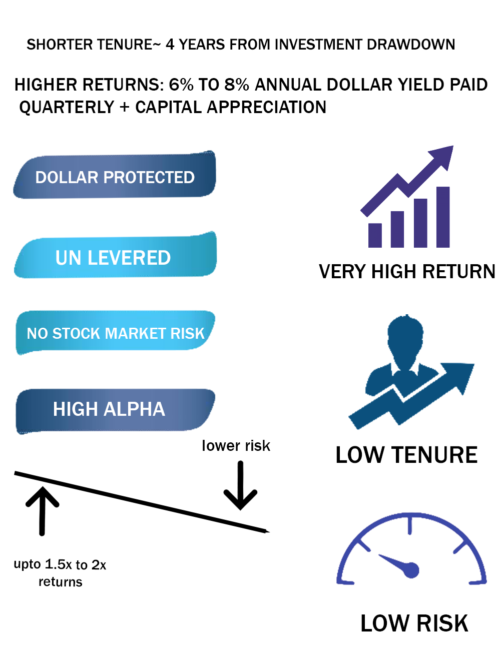

- A Low-risk equity investment, that offers quarterly yield and capital appreciation of up to 1.8x to 2x in dollar terms, within 4 years of investment drawdown, through control transactions in portfolio companies with profitable sectors

- Shorter Tenure: ~4 years from investment drawdown

- Higher returns: 6% to 8% Annual Dollar Yield Paid Quarterly + Capital Appreciation

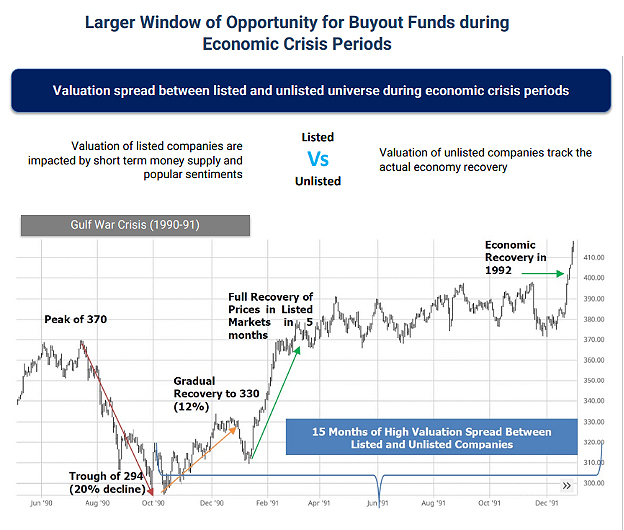

BUYOUT's RETURN IN GLOBAL BEAR MARKETS

The TIWPE Smart Approach

Evaluation

Investment based on market and industry attractiveness, target segment attractiveness, and competitive economic sustainability

Alignment checklist

TIWPE finalizes on companies that parallel investment philosophy and objectives

Buys Controlling Stakes

TIWPE only buys controlling stakes for decision-making rights

Implements Company Transformation

Employs proficient administration to guarantee smooth metamorphosis and thriving of business

Companies with Higher-Dept

De-leverages buy-out by permitting the company to concentrate on operations instead of debt servicing

Buyout Opportunity

Conducts buyouts to return investment to investors with the best returns under minimized risk

Repeat Process

Hunts new companies to invest for investors to earn again